The aviation industry is facing a crisis as parts and labor shortages, delayed deliveries of new airplanes from Boeing and Airbus, an engine recall, and premature repairs are causing a bottleneck in aircraft engine shops worldwide. The repair and overhaul of engines has grown from a $31 billion business before the pandemic to a staggering $58 billion this year, according to Alton Aviation Consultancy. Engine shops are overflowing with work, leaving airline executives waiting anxiously for repairs and overhauls of their engines.

American Airlines Takes Matters into Their Own Hands

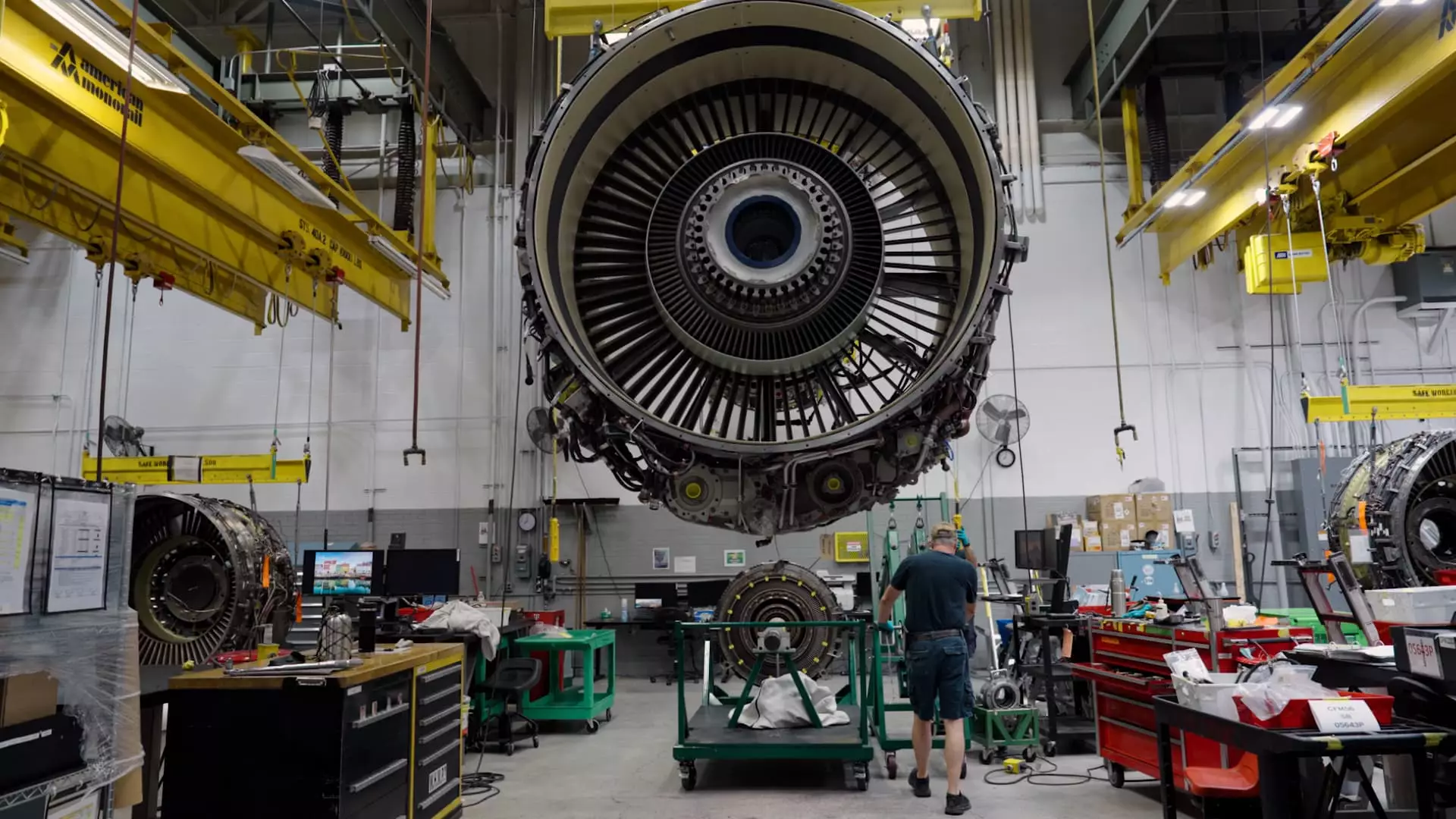

American Airlines is one carrier that is implementing a unique solution to combat the overwhelming demands for engine repairs. By bringing more of the work in-house, American is able to control its own destiny and avoid the lengthy delays faced by outside shops. At their bustling engine shop in Tulsa, American is on track to increase its overhauls by roughly 60%, significantly raising their capacity from five engines a month in 2022 to more than 16 engines a month this year.

The aviation industry’s rocky emergence from the pandemic is a key factor contributing to the current crisis in engine repairs. Companies shed thousands of skilled workers during the travel slump, leading to labor shortages. Airlines that delayed maintenance during the downturn are now racing to get airplanes back in shape to meet the surging demand, but are facing challenges ranging from shortages of skilled workers to key components like engine parts and aircraft seats. Additionally, Airbus and Boeing are experiencing delays in delivering new planes, forcing carriers to hold onto older jetliners longer than planned.

The overhauls for engines are not only time-consuming but also extremely costly, with each overhaul costing millions of dollars. Key parts are hard to find, must be flawless, and come at a high price. For example, engine compressor blades can cost a staggering $30,000 each. The exhaustive overhaul process involves removing hundreds of parts, replacing life-limited components, and cleaning and inspecting others. The challenge of finding the necessary parts and ensuring they meet the required standards adds to the complexity of the process.

The Impact of Engine Recalls and Deferred Deliveries

The Pratt & Whitney engine recall and the deferred deliveries of new jetliners by airlines like JetBlue Airways and Spirit Airlines have further compounded the challenges faced by the aviation industry. Low-cost airlines are deferring new jet deliveries in an attempt to save money, leading to disruptions in the engine supply chain. The high demand for engine overhauls has proven to be lucrative for engine suppliers, with companies like GE Aerospace making billions from maintaining engines they sell with new airplanes.

The Future of Engine Overhauls and Maintenance

As demand for engine overhauls continues to rise, airlines are exploring ways to navigate the current challenges and avoid costly delays. Engine suppliers like GE Aerospace are investing billions in upgrading their engine shops to meet the demand for replacement engines. With rental rates for engines skyrocketing, airlines are faced with limited alternatives to costly overhauls, especially if they operate a fleet with only one type of aircraft or a model that has only one supplier. Despite the challenges, the aviation industry is working towards finding solutions to ensure the smooth operation of aircraft engines in the future.